GWC holds its Ordinary and Extraordinary Assembly General Meeting

Cash dividend QAR 1.9 per share

GWC, the leading logistics provider in Qatar, held its Ordinary and Extraordinary Assembly General Meeting on 4 February 2019 and approved the Group’s Financial Results for the year ended 31 December 2018. The meeting was held in the Four Seasons Hotel Doha, and chaired by GWC Chairman Sheikh Abdullah bin Fahad bin Jassem bin Jabor Al Thani and was attended by representatives of the Ministry of Commerce and Industry, GWC’s external auditors KPMG, the company’s shareholders, and media representatives.

The General Assembly ratified all items on its Agenda including the proposal by The Board of Directors to distribute a cash dividend of 19% the nominal share value (QAR 1.9 per share). The dividends will be distributed through the designated branches of Masraf Al Rayan.

Furthermore, the Assembly heard a thorough review of the company’s compliance with the Corporate Governance Code observed in the State of Qatar. Ernst and Young was appointed as the external auditors. The general assembly also cleared the company’s board members of any possible liability, setting the proper remuneration for the board.

For the company’s Extraordinary Assembly General Meeting, the company presented a number of amendments to the company’s constitution in accordance with the laws and regulations of the Qatar Financial Markets Authority. These included amendments to: Article 2 to comply with the existing activities listed in the company’s commercial registry; Article 5, changing the nominal value of shares from QAR 10 to QAR 1; Article 13, changing the maximum ownership rate from 25% to 35%, in compliance with QFMA Resolution No. 1 for 2016; Article 25 to remove the names of the board of directors; Article 26 limiting the number of shareholding companies that members of the board, the chairman, and vice chairman are allowed to be on; Article 32, adding the phrase: “without resorting to the Extraordinary Assembly General Meeting”; Article 33, governing the number of members that must attend board meetings, requiring the attendance of either the chairman or vice chairman, and the number of votes needed to pass a resolution, so it complies with Articles 14 and 101 of the Corporate Code; Article 36, allowing a board member to sign on behalf of the chairman by virtue of a written authorization; and Article 48 stating how items are added onto the AGM/EGM agenda. The company had included further details on the above amendments in the invitations and on their website for review before the EGM.

GWC Chairman Sheikh Abdulla bin Fahad bin Jassem bin Jabor Al Thani stated: “GWC, by the grace of Allah, is maintaining its position as the leading logistics provider in the State of Qatar, as the Company has continued to support the nation’s growing needs, while laying foundations and strategies in line with the Qatar National Vision 2030.”

The general assembly gathered following a year of achievement for the company, starting with the company entering a management agreement with Al Asmakh Real Estate, placing the Bu Fesseela Warehousing Park under GWC’s management.

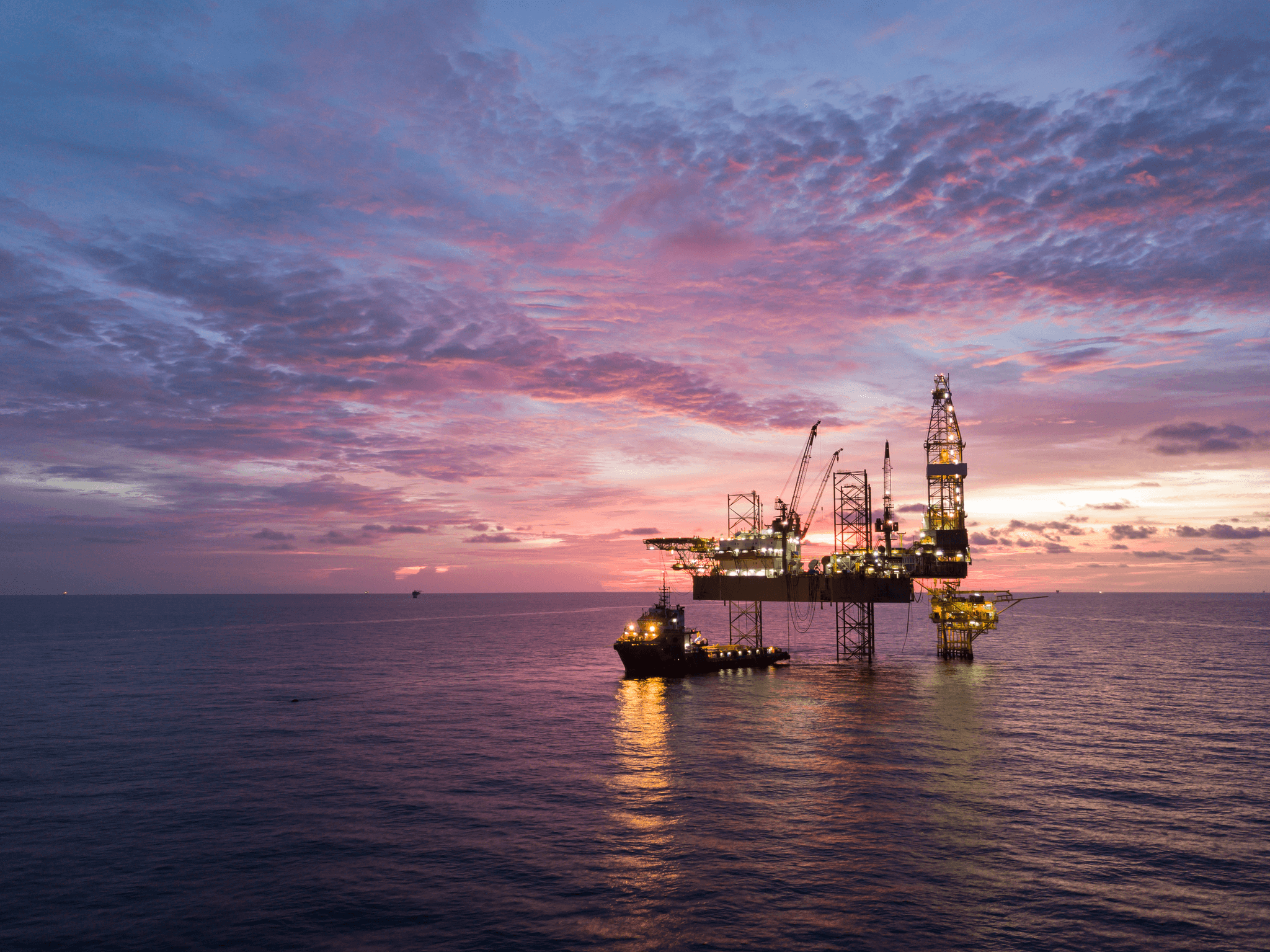

The company also launched a number of new services, while maintaining its presence in the market through its established solutions. Among those recently established were LEDD Technologies, a wholly owned subsidiary of GWC, offering technology services and solutions. GWC also launched GWC Marine operations to offer shipping agency services. Meanwhile, the company’s Contract Logistics, Forwarding, and Projects departments have made major in-roads in developing contracts with clients in the oil and gas, government, broadcasting, and sports sector.

The company has received much recognition in the field: most recently, the company was named “Best Customs Brokerage Company” for 2018 by the General Authority of Customs; and in 2018, the company was awarded “Digital Transformation Award” by Microsoft for its outstanding achievements in leading the company’s digital transformation.

The company achieved net profits of QAR 237.5 million in 2018, representing an increase of 10% in comparison with QAR 215.4 million in net profits listed for 2017. Gross revenues meanwhile reached QAR 1.232 billion at the end of 2018 compared with QAR 981.3 million in 2017. The result was an increase in EPS to QAR 4.04 at the end of 2018, in comparison with QAR 3.68 at the end of 2017.

“GWC’s achievements over the last 15 years reflect the success of our long-term strategy, while supporting Qatar National Vision 2030 in becoming a sustainable and diverse economy, and ensuring the best possible returns to our shareholders, God willing.” Stated Mr. Ranjeev Menon, GWC Group CEO.