GWC to distribute 16% dividend after 11% growth in net profits in 2016

GWC approved the distribution of a dividend to shareholders at a rate of QAR 1.6 for each share, or 16% of the nominal value of the company’s shares, during the company’s Ordinary Assembly General Meeting held on Monday, January 30, 2017. The dividends will be distributed either through direct deposit on February 7, 2017, or by visiting the designated branches of Masraf Al Rayan from February 8, 2017.

The twelfth GWC Ordinary Assembly General Meeting was held yesterday, Monday January 30, 2017 in the Four Seasons Hotel Doha, chaired by GWC Chairman Sheikh Abdullah bin Fahad bin Jassem bin Jabor Al Thani, and was attended by representatives of the Ministry of Economy and Commerce, GWC’s external auditors KPMG, and the company’s shareholders.

In addition, the assembly heard a thorough review of the company’s compliance with the Corporate Governance Code observed in the State of Qatar, as well as the assignment of KPMG as the appointed external auditor. The general assembly also cleared the company’s board members of any possible liability, setting the proper remuneration for the board.

“We remain committed to delivering the best solutions and logistical infrastructure, partnering with our nation in our collective quest for achieving the goals of Qatar National Vision 2030,” stated GWC Chairman Sheikh Abdulla bin Fahad bin Jassem bin Jabor Al Thani. “We are confident that in doing so, we will remain on the path towards continued growth in the near and far future, God willing.”

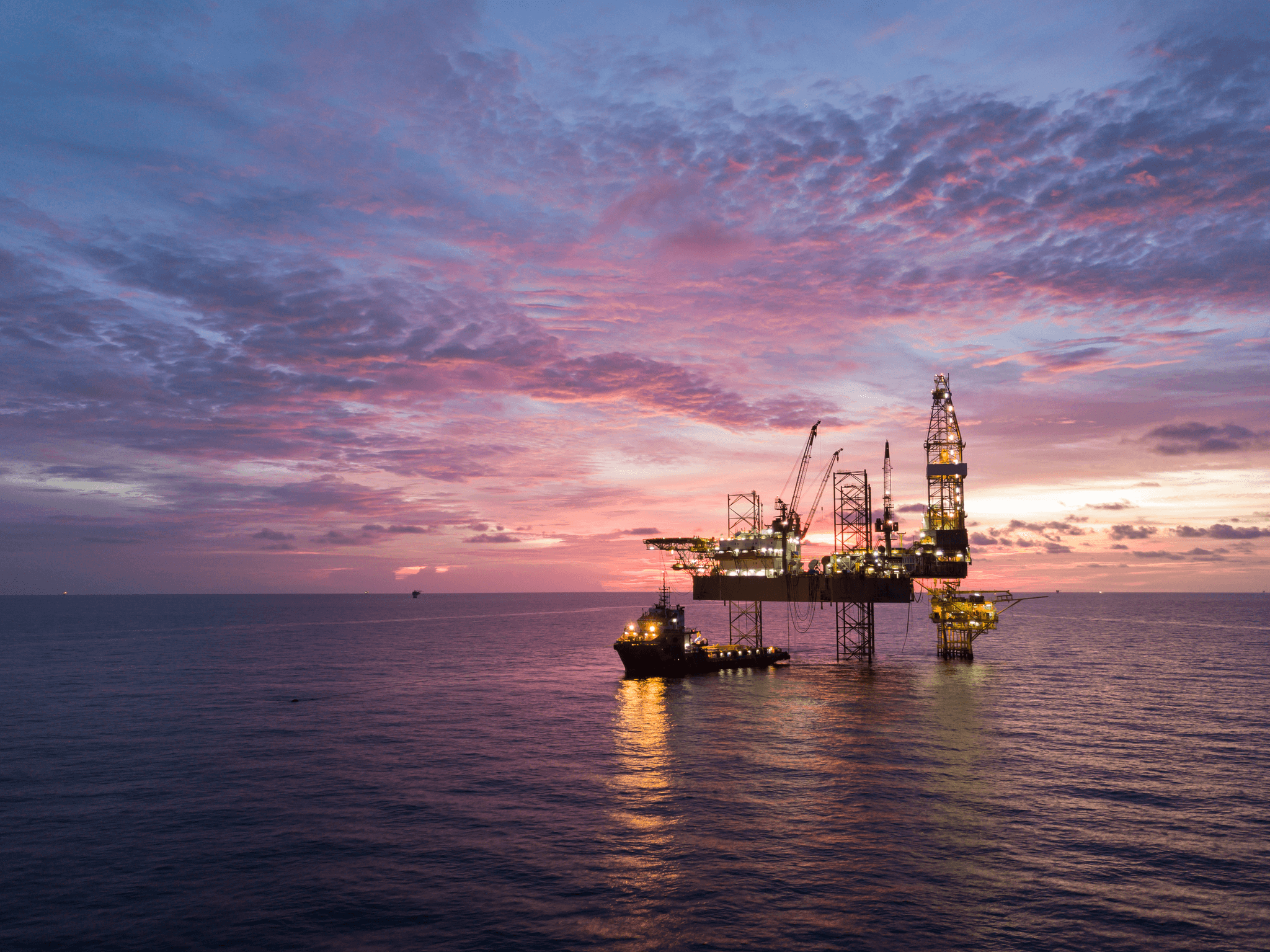

The general assembly has gathered following a year of achievement for the company. The GWC Bu Sulba Warehousing Park has completed construction works and is in the process of handing over the warehouses to the tenants. Phase V of the LVQ and the WSSA warehouse in the Ras Laffan Industrial City hub have both launched operations in 2016.

GWC Contract Logistics expanded on a number of their contracts, completing the roll-out of several programs it had begun for clients in the health, retail and telecom sectors. GWC Forwarding held on to its position as the leading freight forwarder in the State of Qatar, and enhanced value for its clients’ projects by offering new products that reduce turnaround time for many shipments. GWC Records maintained its client retention record while adding clients among ministries, government authorities and financial institutions.

Meanwhile, GWC Relocations, Fine Art, and Transport expanded on the types of services they offer while making significant contributions to the company’s revenues.

The company had achieved net profits of QAR 205.7 million in 2016, representing an increase of 11% in comparison with QAR 185.2 million in net profits listed for 2015. The company has maintained its growth by increasing its operational efficiency, improving its profit margins, and actively seeking new revenue streams, drawing in gross revenues of QAR 849.5 million at the end of 2016, representing 8% increase from QAR 787.9 million in 2015. The company’s assets continued to develop, with total assets reaching QAR 3.741 billion by the end of December 2016, compared with QAR 2.981 billion at the end of December 2015, representing a 26% growth.

“We have maintained a certain rhythm as we evolved over the last twelve years, growing from an exclusively warehousing company to the provider of the largest range of fully-integrated logistics solutions in the Qatari market and beyond,” concluded GWC Chairman Sheikh Abdulla bin Fahad bin Jassem bin Jabor Al Thani.

“The company will continue to rely on the strength and stability made possible by our robust infrastructure and by our highly skilled and loyal employee base as we set our strategies for the future.”