GWC upbeat for 2019; confident of posting promising results

By Mohammad Shoeb I The Peninsula

Qatar’s logistics and warehousing industry has huge untapped growth potential as currently only a small share (less than one-fifth) of the existing market potential is tapped by the local companies, said a top official of GWC, the leading logistics and warehousing services provider in the country.

On the back of that GWC is very upbeat about the year 2019, and the company is firm to maintain its growth momentum for this year as well as coming years that it has been registering for over the last one decade.

“Qatar’s logistics market has significant potential to grow. Looking at the outsourced components of the logistics of warehousing, it’s only a small percentile, may be in the range of between 10-15 percent of the total warehousing market. So we see a great potential to grow,” Ranjeev Menon (pictured), Group CEO of GWC, told The Peninsula.

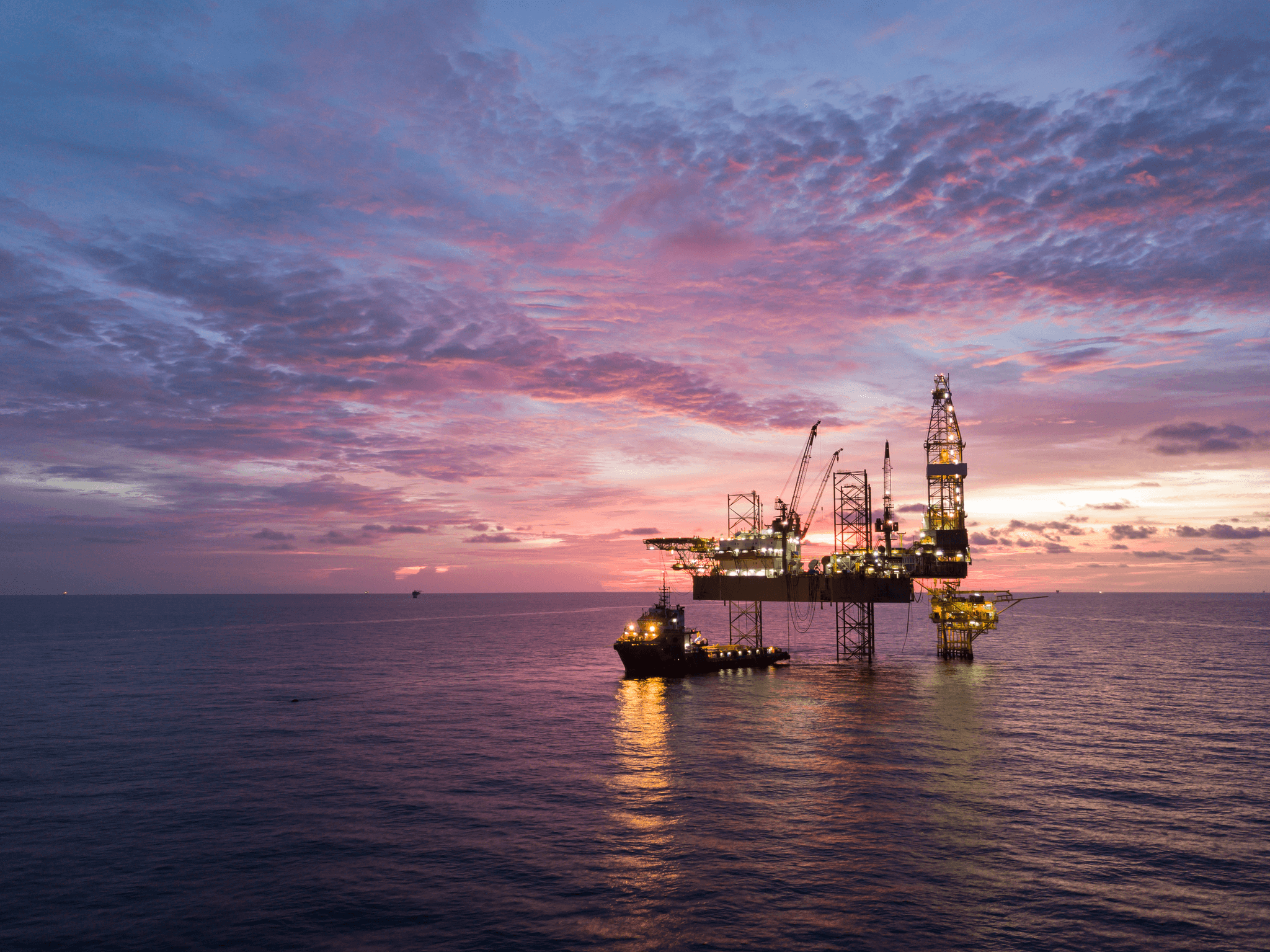

Menon added: “We are diversifying our operations predominantly within the logistics sector. In 2018 we added a new revenue stream, or product namely –GWC Marine—along with a few other products. These are the new platforms we are currently focusing on as part of our expansion programme.”

About the growth prospects for 2019, he said that this year will not be easy in terms of revenue generation, but the company has developed capabilities, products and services that will help sustain the growth momentum not only for 2019 but also for the coming years as the company has been able to maintain the growth momentum for more than last 10 years.

Commenting on market competitiveness and prices of products and services compared to that of other regional logistics companies, he said that market is very competitive given the integrated solutions that GWC offers.

He explained that it is not just the direct relation to the prices that you can compare the competitiveness, it is what the clients get for that price. “It is a core value addition that comes with that number which needs to be taken into account. So the total cost of getting a particular service needs to be compared to the comparable element.”

He noted that 2018 was a great year for the company and its shareholders. With the addition of revenue streams (GWC Marine and LEDD Technologies—a wholly-owned subsidiary of GWC) the company is very optimistic about maintaining the growth trend, in terms of revenues and profits, and expecting to post good results for 2019.

The company had reported net profits of QR237.5m for 2018, representing an increase of 10 percent in comparison with QR215.4m in net profits listed for 2017. Gross revenues meanwhile reached QR1.23bn at the end of 2018 compared with QR981.3m in 2017.

However, some analysts say that the market in 2019 is expected to be difficult due to several factors, including the fiscal consolidation, dwindling oil prices and trade disputes between major economies of the world.

Asked about GWC’s expansion in overseas markets or forming joint ventures, the CEO said: “There are several initiatives that we are pursuing at the moment but we will announce only at the right time when things conclude for us.”

For more, please follow the link:

Or contact us at cc@gwcenergy.com